Special Situation: $MFI - 20x Potential

Inside $MFI’s quiet pivot — and how it mirrors 10–25x crypto treasury plays

Several microcap companies have recently undergone crypto treasury pivots, with some rising 10–25x in a matter of weeks.

These companies follow a repeatable pattern: 1. control change, 2. new leadership with crypto exposure, and 3. treasury deployment.

I believe there is significant evidence MFI 0.00%↑ is following the same trajectory.

Step 1. Control Change

On May 22, Dawei Yuan — cofounder of HTX (formerly Huobi, one of the largest global crypto exchanges) — acquired all of $MFI’s Class B shares, giving him voting control over the company.

Step 2. New Leadership with Crypto Exposure

On June 3, $MFI filed an 8-K detailing major leadership changes:

New CEO and CFO installed — with backgrounds tied to Yuan’s crypto and venture operations.

New board members also includes a former UN official with Middle East ties (maybe this suggests there is middle east backing as well?).

Step 3: 10-25x Case Studies on Treasury Deployment

Based on company actions and market trends in the crypto and public markets, I believe a crypto pivot announcement is imminent. DeFi Development Corp (Nasdaq: $DFDV) and Sharplink (Nasdaq: SBET 0.00%↑ ) serve as case studies in how significant the upside can be.

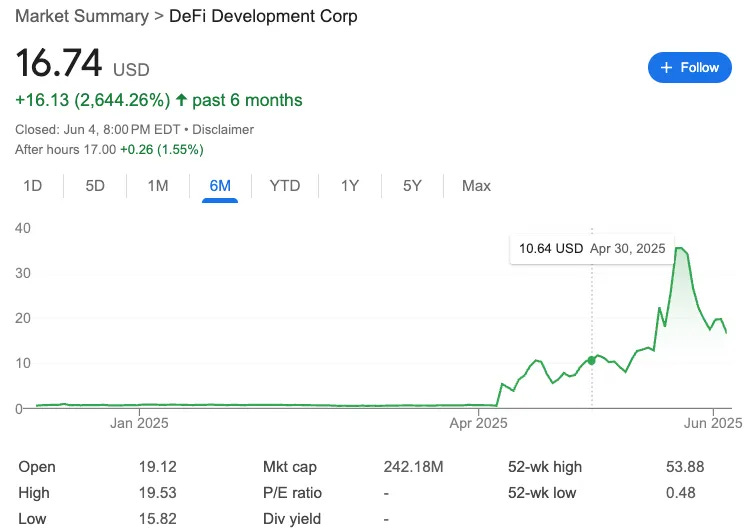

DFDV 0.00%↑ — 25x in Two Months

April 4: New leadership is installed at ~$0.60/share

April 7: Price closes at $5 after acquisition and crypto treasury announcement

Today: ~$16/share following SOL purchases, validator investments, and yield strategies

SBET 0.00%↑ — 10x via PIPE

May 27: $425M PIPE at $6.15/share — 2x premium to prior trading levels

Joseph Lubin (Ethereum co-founder, Consensys CEO) joins as Chairman

Result: Stock rallies 10x in a month

Where Is $MFI Now?

Relative to these case studies, $MFI appears to be in the early stages:

Leadership aligned with crypto venture capital has just taken control.

The last few weeks have been the laying of strategic groundwork with what is likely a crypto treasury announcement.

I also think a PIPE structure is more likely, given that Class B voting shares are already consolidated.

The name has already got some buzz but I still think it’s under the radar. There was even recently a sell-side analyst who initiated research but it was entirely on the core biz which isn’t the focus of this write-up.

My take is if $MFI follows the playbook of $DFDV / $SBET, which all signs are pointing to, there is still major upside.

Credits

Credit to

for digging through the SEC docs- for looking into the leadership team

Hope my addition comparing some case studies to assess likelihood + upside potential is helpful.