Pudgy Penguins NFT Omega-Thesis

Crypto's greatest value investment

Thesis:

NFT to memecoin market cap has reached its cyclical low

The Pudgy Penguins memetic IP flywheel is hitting terminal velocity onchain & IRL

CEO @LucaNetz is a generational operator and winner

Why this opportunity exists:

@Pudgypenguins dominate mindshare on EVM, non-EVM, and most importantly IRL. Market participants however are too siloed in their own camps to see that Pudgy Penguins is becoming the first project to link all three groups globally.

Investors have deemed NFTs "cringe" & uninvestable on EVM following the letdown of projects like Bored Ape Yacht Club and Solana stealing memecoin season but early signs show the cycle is turning.

My variant views:

Near-term: Pudgy Penguin NFTs are the best asymmetric opportunity to accumulate $ETH during this run because 1. NFTs are denominated in $ETH and 2. The cyclical low of NFTs to memecoin market cap provides downside protection.

5 weeks ago, I acquired an $SBET (Ethereum Co-Founder - Joseph Lubin's $ETH Treasury Co) position at $11.97 and ~1.35 NAV, and have exited at $37 and 3.3 NAV to acquire as many Pudgy Penguin NFTs as I can the past few days. I currently own 5 and am moving funds to acquire more (lesson learned on staking lockups).

Long-term: I believe the Pudgy Penguins IP has the potential to reach the heights of original Disney and Hello Kitty. While this sounds crazy, Pudgy Penguins has an opportunity to become the world's first crypto fueled memetic IP flywheel that becomes omnipresent in daily life the same way the incumbent global IPs are.

When something enters the cultural zeitgeist, in hindsight, it always looks inevitable. Please allow me to share why I have conviction that Pudgy Penguin NFTs are at this inflection point.

1. NFT to memecoin market cap has reached its cyclical low

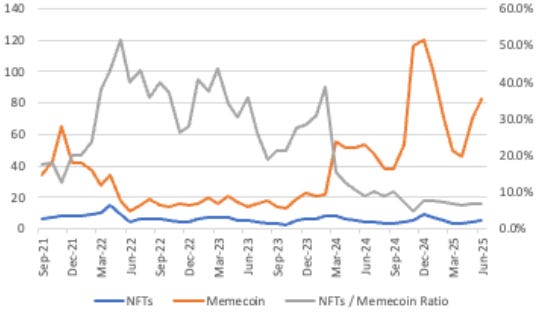

Historical % NFT to memecoin market cap ($ bil):

Source: coingecko & Coinmarketcap

May 2022 Peak: 51%

Historical Average: 23.3%

Current: 7.0%

When a certain category of crypto-asset underperforms for even short periods of time, they are dismissed and the underperformance is assumed into perpetuity. However if you invested in a Cyber Punk ("blue chip" NFT) when the ratio declined to 10% starting June '24, you would have made a meaningful return on both an $ETH denominated $ nominal basis.

I didn't find any screeners or terminals where I could easily overlay the marketcaps of the two asset classes so I had to manually get all the datapoints for the chart (if someone knows a place please lmk). However I believe this relative valuation framework is going to be important for the two asset classes going forward because Pudgy Penguins is creating a new economic model in real time where there's a value ladder from starting as a $PENGU holder -> Lil Pudgy NFT holder -> Pudgy Penguin NFT holder -> a rare Pudgy Penguin NFT holder. Soon every NFT project will have memecoins and vice versa and this misunderstood relative valuation is leading to the current buying opportunity.

Runescape for many in crypto is our first experience of a digital economy and provides some directional case study. The game's rarest items were party hats obtained in one of the first holiday events in the game's history where players obtained an event-exclusive yet tradeable item.

They were released in 2001, and by 2006 the market cap of the party hats represented 2/3s of Runescape's GDP and in the following years the developers would have to change the game economic mechanics because the price of the hats exceeded the value of the max gold stash causing the party hat market cap to be multiples of Runescape's GDP.

Source: https://www.tip.it/runescape/times/view/28-the-rares-market +

The current $PENGU token FDV is $3.2B vs. Pudgy Penguin NFT market cap of $550M representing just 17%. This feels undervalued given that NFTs share the same quality meme coins have but also have the added element of scarcity + degrees of rarity inherent to NFTs.

On top of this, the Pudgy Penguin NFTs don't live in a closed system like Runescape party hats. There's an additional utility layer from a brand perspective with being associated with Crypto's mascot as well as being associated with the many Crypto OGs that still rock their Pudgy Penguin pfps.

Marathon Asset Management (historic value investment firm) pioneered the Capital Cycle investment approach. My adopted version for crypto: when a asset class underperforms, market participants exit to pursue the next shiny thing -> investment declines, team exits, and investors become pessimistic -> improving markets or outperformance elsewhere leads to a rotation back causing outsized returns on a forgotten asset -> increased competition from new entrants chasing diminishing returns or declining market conditions causes underperformance... and so the cycle continues.

The goal is then to 1. understand when the cycle is turning and 2. find the winner of the next cycle.

Market cap of NFTs has risen 40% the last seven days rising on both an $ETH denominated and nominal basis. My overall take is that there is still strong momentum for Ethereum broadly: tech fundamental improvements (scalability from upgrades + L2s), narratives from stablecoin and institutional adoption, recent partnerships like @arbitrum and Robinhood, and the influx of corporate treasury vehicles whose sole mission is to acquire $ETH. If I'm wrong about the cycle, the valuation cyclical low of NFTs presents enough downside protection relative to the upside imo.

Even if I'm totally wrong about the cycle turning, Luca Netz and Pudgy Penguins are undeniable. The Pudgy Penguin NFTs are the equivalent of Amazon's original bookstore, the foot in the door before world domination. While market participants have remained in their respective silos, the @IglooInc has been silently capturing every part of the consumer value chain both in daily life and on chain. Part 1 of my thesis is why I acquired the Pudgy Penguin you see now, but parts 2 and 3 are why I acquired 4 more and am in the process of accumulating as many as I can.

2. The Pudgy Penguins memetic IP flywheel is hitting terminal velocity onchain & IRL

The memetic flywheel begins with the Pudgy Penguins NFT and it's why I believe they are the crown jewel of @IglooInc.

For every NFT transaction, Igloo earns a 5% royalty.

From the royalties, the team deploys capital to take over the mindshare of both on-chain and IRL audiences. Pudgy Penguins have generated 180B+ total impressions and are currently on track by year end to generate 1B+ average daily views across their social media platforms to predominantly non-crypto folks.

The impressions then convert participants into the Pudgy Penguin ecosystem, who now have a social, financial, and emotional incentive to also spread Pudgy Penguins into the mindshare of their peers.

All these views lead to increased NFT volumes and royalties which they can deploy back into acquiring more mindshare both IRL and on-chain.

The virtuous cycles continues with the NFTs representing a Franchisee / Franchisor relationship.

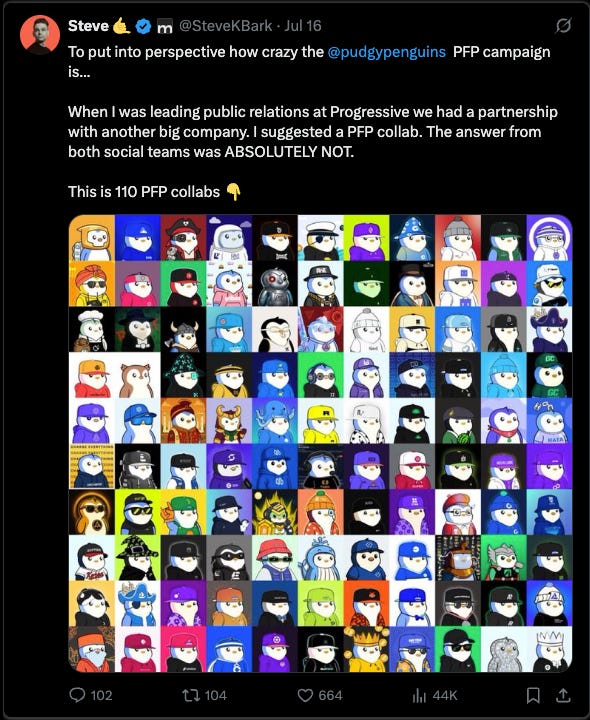

It boggles my mind that for $40k I and am now associated with the 100+ institutions (Coinbase, Binance, etc) who did an unpaid PFP collab with Pudgy Penguins + I have an infinite supply of branded assets for whatever venture I want to pursue.

These collaborations happened because of the memetic flywheel. The companies know that the 1 million $PENGU holders and holders of the Lil Pudgy and Pudgy Penguin NFTs are going to share and like their posts.

Their IRL distribution is perhaps more impressive. Their distribution strategy is to leave no stone unturned. There's a Pudgy Penguin distribution plan and product for every age, gender, race, country, personality type, and (probably) pronoun.

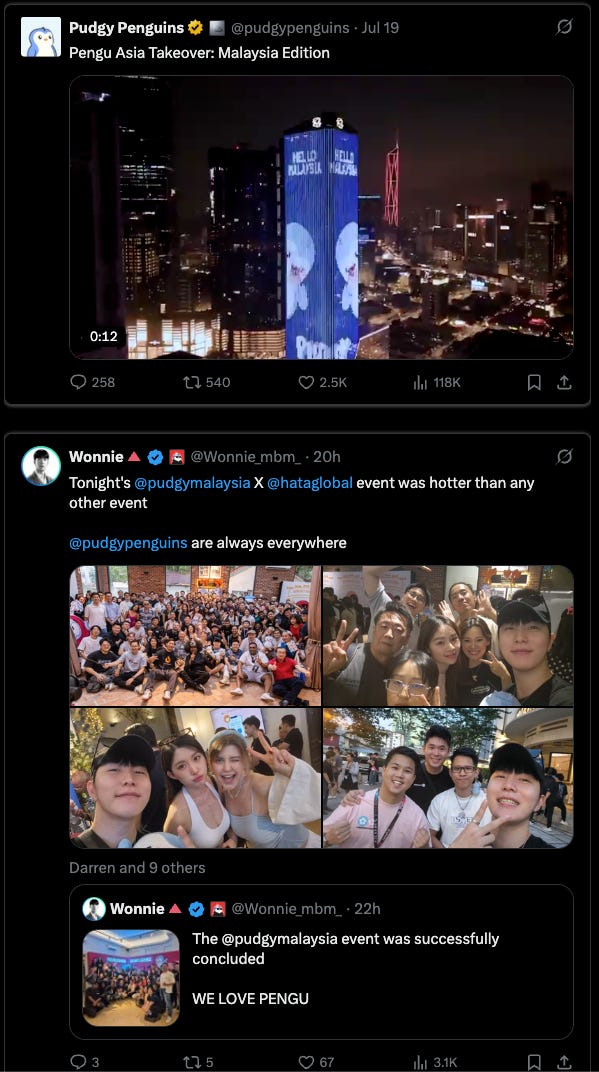

The team has also emphasized the importance of Asia and International and how they're the source of some of the biggest fans.

Pudgy Toys are now in Japan's largest convenience store:

And Pudgy Penguin x Malaysia appeared to be a well received community event:

The memetic flywheel is already in effect and with the increased NFT royalties, the team is taking bigger swings.

Warren Buffet said the following regarding his investment in Coca Cola: "If you can shave even a fraction of a penny off the cost of every can, across billions of units, that turns into real money.”

If Igloo can increase conversion, and we're talking about micro bps here, across 1 billion average daily views, the economic impact will be massive. If Igloo can increase the avg economic value per conversion, that would also have a similarly significant impact.

If they can achieve both, this would be the first time the world will have witnessed a crypto-fueled memetic flywheel take over the world. And that's exactly what they're attempting...

Their goal is to utilize their 1B+ daily avg views + the successful "leave no stone" unturned distribution strategy to capture every part of the consumer on-chain “value chain”.

They are taking 2 major swings that represent significant catalysts for the investment and value chain capture:

@AbstractChain Launch

@opensea Acquisition

Abstract L2 Chain Launch

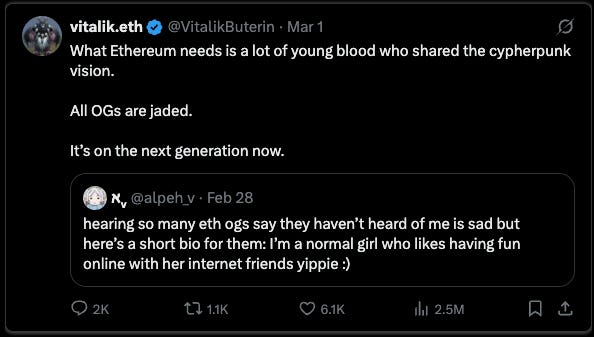

Ethereum needs Pudgy Penguins and Abstract Chain.

Abstract is one of many L2s, but unlike the other dead L2s with no activity, there is a reason Luca and team are building it.

Luca said in an interview that they were offered $20-30M to build on another L2 but decided it would be more value accretive to build their own L2 as they own the distribution which is the hardest thing to achieve in crypto. In the interview he said (paraphrase): L2s are like LLMs... they're all within a degree of separation and the majority of user really don't care. Since our superpower is front end, acquiring users, and distribution, we should accrue the value ourselves.

Thus Abstract was born with the mission to "Make Ethereum Fun Again" (might be a paraphrase). Ethereum desperately needs fun if it wants to attract the young bloods who share the cypherpunk vision.

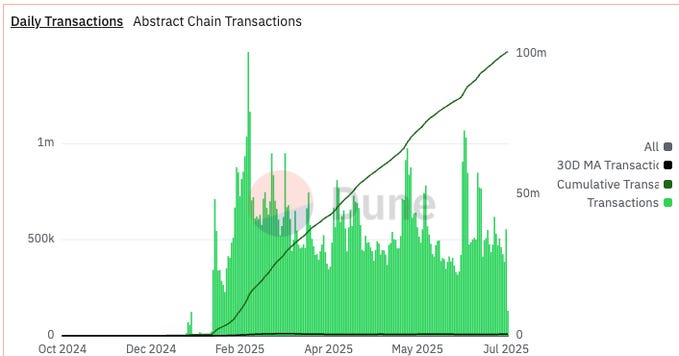

They are currently at 500k daily transactions and have just passed 100m cumulatively.

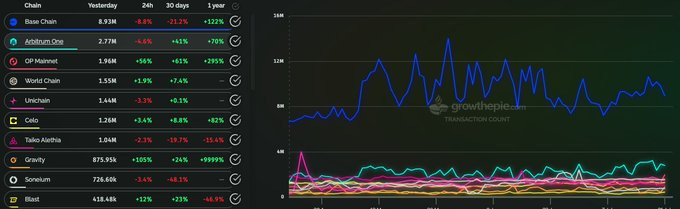

What's also interesting to note is @growthepie_eth whose mission is to provide L2 analytics doesn't have one of the most active L2s on their portal! This further reinforces my point that the EVM and non-EVM groups are too siloed to miss a generational investment opportunity.

My quick review of Abstract: the games on there don't seem too differentiated but the gamified social experience + streaming adds a compelling element especially for new users. They have their own integrated wallet, so the onboarding experience is significantly easier compared to the deposit into a CEX -> wait a few days -> withdraw to Metamask... however I still think there's still work to be done to make it a truly seamless experience that Luca envisions.

My take is the first non-crypto native power users are e-girls who can capture larger audiences and earn through donations + referrals via gamefi or gambling platforms on Abstract.

OpenSea Acquisition

The OpenSea acquisition has been rumored for a while but recently there's been more smoke as Luca in calls and other talks keeps hinting at a major announcement and has said this on record recently:

If indeed true, they would own the largest platform for NFT trading, and as a reminder their business model and the entire flywheel is driven by royalties earned from their NFT volumes.

While these catalysts are significant, the deepest part of my conviction comes in the final part of my thesis.

3. CEO @LucaNetz is a generational operator and winner

I urge anyone interested in investing across the Pudgy Penguins multiverse to listen to some of @LucaNetz many public talks. If you search on Youtube you'll see 1. he will take any opportunity to speak about Pudgy Penguins and 2. he consistently talks about compounding and how every little action matters. It's why he is so involved in the grass roots like the @kindpengu shorts, it's why he still slaps Pudgy Penguin stickers anywhere he goes, and it's those small actions that have compounded over time which have led to you into reading this today.

At 21 @LucaNetz acquired the Pudgy Penguins project for $2.5M. He's a highschool dropout who grew up in the PVP world of sneaker flipping and later e-commerce where he sold his biz for multiple millions to eventually acquire Pudgy Penguins.

I think of Luca as: if Kobe Bryant was into NFTs instead of basketball.

Anytime Luca talks he mentions how badly he wants to win and it's clear he holds himself and his team to this standard. No stone goes unturned as demonstrated by their successful distribution strategy and every little action matters because every little thing compounds.

Pudgy Penguins is already one of Crypto's most successful stories. A dead project bought for $2.5M that generates $30M - $70M (my rough estimate based on volume and sales across product lines).

The team could have taken that $25M check, launched on another L2, and rode off as winners as the flywheel they've built continued to print them money. Instead they decided to make capital allocation decisions for the long-term which meant building Abstract Chain and "making an acquisition" in December (it's OpenSea) to increase conversion and value capture on their 1B+ average daily impressions.

On last week's Inner Igloo call (11AM EST on Sunday so the Asia Community can attend) Luca spoke of how badly he wants the upcoming @PlayPudgyParty mobile game to reach #1 on the app store which has "never been done in the history of crypto... we've still got a ways to go but I'm gonna do everything I can to make that happen".

He often talks about "crypto's greatest moments" of which Pudgy Party has contributed many: multi-million sales of plushies at Walmart, $4 billion $PENGU token airdrop (no presale), and others. He'll claim some are "Top 10", sometimes he'll say its "Top 5" but he'll usually backtrack.

My takeaway is he's looking for his fat pitch, he's hunting for crypto's biggest moment.

"In business, every once in a while, when you step up to the plate, you can score one thousand runs. This long-tailed distribution of returns is why it's important to be bold." - Jeff Bezos

My bet is he gets it this cycle. But the best part of betting on winners is they'll never stop wanting to win.

Structural Supply and Demand

Hal Press in his Ethereum thesis a few years ago wrote: "Over a short period of time prices are driven by discretionary supply and demand, but over the medium to long term they are driven by structural supply and demand".

Currently the prices of Pudgy Penguins have been rising primarily due to this discretionary trading led by the Capital Cycle rotation I described in the earlier part of the report.

However it's the structural supply and demand forces over the medium and long-term that makes Pudgy Penguins NFT my asymmetric investment this cycle and why I consider it a generational investment opportunity.

Structural Demand:

Every incremental user that the flywheel adds who buys a $PENGU memecoin (or is even gifted some such as through a plushie purchase) increases the demand of the NFT.

There are a set number of NFTs and we are biologically programmed to seek scarcity and rarity. It's why people (girls) go crazy for labubus, for Hermes bags and it's the basis for whole economic systems (bitcoin/gold). There are currently 1 million wallets holding $PENGU and this will increase non-linearly as the memetic flywheel spins and the team improves conversion and value accrual via Abstract, OpenSea, and big IRL bets like their upcoming game, the Lil Pudgy kids show, and the team has even hinted at movies and a Netflix show.

The Abstract Chain will revolve around $PENGU and the NFTs. Even now users are provided additional rewards by acquiring and $PENGU and the NFTs.

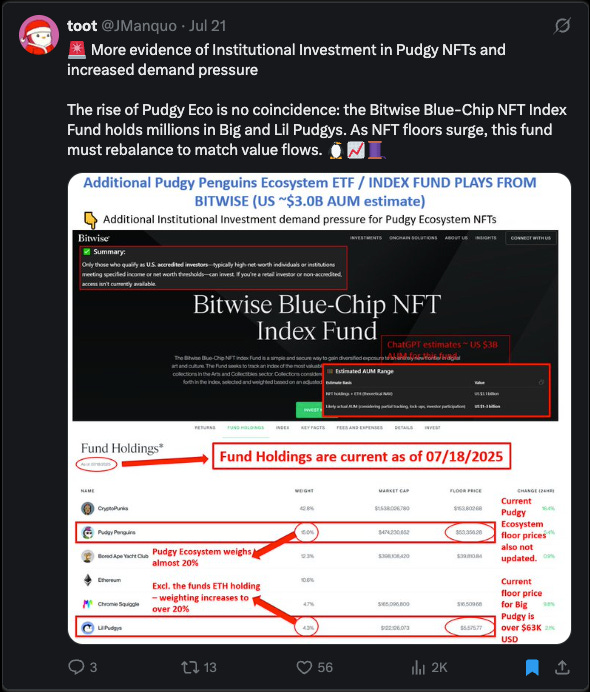

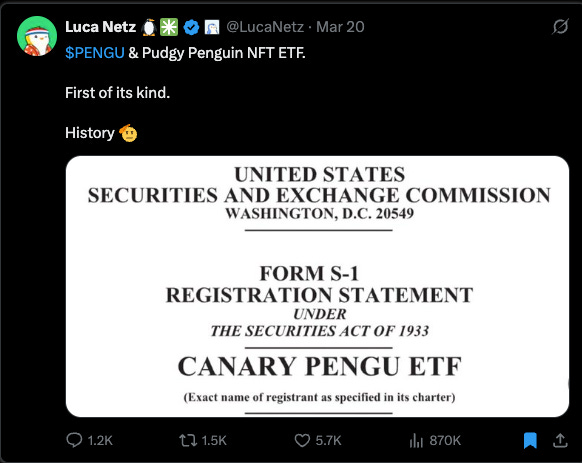

Another near-term source of structural demand are NFT ETFs. There's already an NFT ETF (80% YTD performance) that systematically invests across "blue chips". While in a sell off, this represents structural sell pressure, however I believe in the near term given the small NAV and general lack of ETFs in the asset category, the demand for NFT exposure in an institutional/HNW capacity still isn't met. Additionally, the Pudgy Penguins team has already submitted their Form S-1 for the first memecoin + NFT ETF.

Mechanics of a Supply Shock:

The Runescape party hats are an interesting case study as it gave a scenario of what happens when there is compounding structural demand with limited supply. The scarce asset became so valuable they had to change the fundamentals of the game.

Over time there will be NFTs that are forever lost in dead wallets. I also believe over time the willingness to sell your NFT decreases not only as this scarcity value is realized but as the financial and emotional attachment increases. What happens if this report gets popular and I want to continue writing? (Don't worry I'm not selling you Pudgy Man). You can apply this logic to the crypto OGs who still rock their Pudgy Penguin PFPs to this day. These are effectively cut from the supply pool. What happens when the next Pudgy Penguin holders events brings in the e-girls I mentioned who onboarded to Abstract's streaming platform? That's going to make it harder for (read me) to sell.

How I'm Positioning

I currently own 5 Pudgy Penguin NFTs and am in the process of acquiring 1 more. The one you see is my forever hold, I've also acquired 2 'legendary/orange' ones to test my long-tail hypothesis that rare Pudgy Penguins should trade at a higher premium vs. the floor price (currently a % premium vs multiples), and the other 3 penguins I will sell into my Price Target located at the end of the report.

I also hold ~100K $PENGU (a few thousand $ nominal) tokens and a Lil Pudgy NFT to earn bonus EXP on Abstract ahead of TGE.

Risks

The biggest risk is we enter such a risk off scenario that both $ETH prices along with the Pudgy Penguin $ETH floors decline. As I’ve continued reiterating, I believe there is currently enough downside protection given how cyclically low NFTs are trading. I view that in most downturn scenarios, there is limited chance of permanent capital loss.

Short and medium-term catalysts don't generate enough hype and buying pressure. I'm okay with this as my conviction is primarily driven from the structural demand that the flywheel is generating which will be more significant in the medium-long term.

Irreparable damage to the Pudgy Penguin IP. I view this as a blackswan type event and not something I'm considering. If Disney can come back from the Snow White remake, Pudgy Penguins can come back from anything.

Conclusion

I sometimes like to visualize what the early investors in Amazon, Bitcoin, and TSLA may have felt when they discovered these unique opportunities. I'd imagine them feeling that the opportunity was a no-brainer and I also think that through whatever niche or circle of competence they had, they knew why others couldn't see an 1000x in front of them. I wouldn't really know because I've never had an such a hit, but I can say this is first time I've felt close.

It's one thing to identify these opportunities, it's another to buy into the vision and hold through the ups and downs. Many investors sold Bitcoin, Amazon and Tesla too early. So to hold myself accountable, I'd like to end my thesis with...

Price Target: 420 ETH Floor

If you made it here, thank you, it means a lot you read my work.